Fractional NFTs explained

29/04/2022

Crypto enthusiasts rejoice! A new form of NFT, “fractional NFTs,” has been unleashed on the blockchain. What does that mean for you and your cryptocurrency investments?

This post will break down what fractional NFTs are, how they work, and why they may be a good investment opportunity for you. Stay tuned to learn more!

What are fractional NFTs?

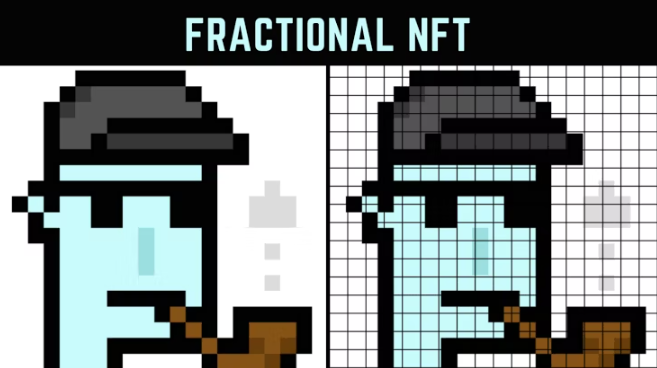

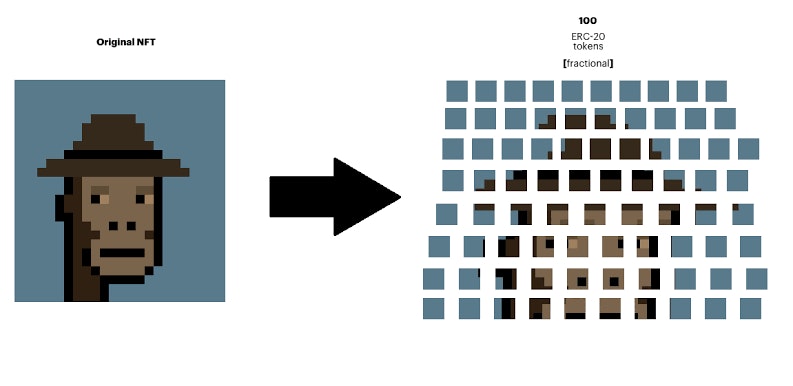

Fractional NFTs are digital assets that can be divided into smaller units. This means that you can own a partial interest in an NFT rather than the entire asset. For example, you could own 1/100th of a piece of NFT artwork.

The concept of fractional ownership is not new. It has been used for physical assets such as property and works of art for many years. However, fractional ownership of digital assets is a relatively new idea.

There are several platforms that allow you to buy and sell fractional NFTs. These platforms typically use blockchain technology to track ownership and transactions.

How do fractionalized NFTs work?

Fractionalization is made possible by the use of blockchain technology. Blockchain is a distributed database that allows for secure, transparent, and tamper-proof transactions. When an NFT is created on a blockchain, it can be divided into smaller units, each with its own unique identifier. These units can then be traded or sold independently of each other.

Fractionalized NFTs have the potential to revolutionize the way we use and trade digital assets. By making it possible to trade or sell portions of an NFT, they open up new possibilities for how these assets can be used.

For example, fractionalized NFTs could be used as currency or as a way to buy and sell goods and services. This could potentially lead to the creation of entirely new markets and economies built around NFTs.

Why would you want to own a fractional NFT?

There are several reasons why you might want to own a fractional NFT.

1. First, fractional ownership can make NFTs more affordable.

If you can’t afford to buy an entire NFT, you may be able to buy a smaller unit of the asset. This would allow you to invest in NFTs that would otherwise be out of your price range.

2. Secondly, fractional ownership can make it easier to sell NFTs.

If you own an entire NFT, you will need to find a buyer willing to pay the same price (or a higher price!) that you paid for the asset. However, if you own a fractional interest in an NFT, you can sell your stake to multiple buyers at different prices. This could make it easier to find buyers for your NFTs.

3. Finally, fractional ownership can provide diversification benefits.

If you own a portfolio of NFTs, you may want to consider investing in fractional NFTs to spread your risk. For example, if you own an NFT that is based on a single cryptocurrency, you could mitigate your risk by investing in fractional NFTs that are based on different cryptocurrencies.

What are the risks of owning fractional NFTs?

When it comes to fractional ownership of NFTs, there are a few risks involved that potential investors should be aware of.

1) First and foremost, fractional ownership structures can be complex, and it may be difficult to understand all of the terms and conditions associated with your investment.

If you’re not careful, you could end up inadvertently agreeing to unfavorable terms, or you could make changes that have a negative financial impact on your ownership stake.

2) There is also the risk of losing access to your fractional NFTs. If you own an entire NFT asset, then you always have full control over that asset. However, if someone else owns part of your NFT asset, they could steal or change the data associated with your portion of the asset without your permission.

For this reason, it’s important to choose platforms and partners carefully when buying or selling fractional NFTs.

The following risks are common to all NFT trading, whether you are buying a single, whole NFT or a fractional share, but it’s worth mentioning them here:

3) It’s important to remember that NFTs are still a relatively new asset class, and as such, they are subject to high levels of volatility. This means that the value of your investment could go up or down at any time, and you could end up losing money if you don’t carefully monitor the market.

It’s best, then, to only invest in fractional NFTs if you are confident that you can tolerate the volatility.

4) Finally, there is a risk that fractional NFTs could be subject to fraud or scams. For example, someone could create a fake NFT asset and sell fractional ownership stakes in that asset to unsuspecting investors. The scammer can then take the money and run, causing the investors to lose their entire investment.

For these reasons, it’s essential for anyone considering investing in NFTs to do their research and understand the risks before making any decisions. In doing so, you can protect yourself from losing money and ensure that your investments are as lucrative as possible.

At the end of the day, there is always some level of risk involved when investing in any type of asset. However, with careful planning and due diligence, you can minimize those risks and help ensure that your investment will be successful over the long term.

Wrapup

Fractional NFTs are an affordable way to invest in high-value NFTs without having to fork over all of your hard-earned money. They’re also an excellent means of diversifying your NFT portfolio when you have a limited amount of cash available for investing.

If you’re just now getting started buying NFTs, fractional NFTs might be the perfect way to get your feet wet without committing too much money and taking on too much risk.

On the other hand, if you’re an experienced NFT trader, fractional NFTs offer the possibility to buy those NFTs that you’ve always wanted to try, but were just out of your reach.

Either way, fractional NFTs are a great way to get more involved in this exciting and growing market.

Chat with the expert NFT promoters and marketers at Mooning

Sure, all the examples of NFT promotions we listed are from global brands with endless coin to throw at their campaigns. But you really don’t need a crazy-high budget to see some seriously incredible outcomes – as long as you know the delicate intricacies of building a killer NFT marketing strategy!

If not, no worries – Mooning is here to take care of everything for you and make sure you see the most amazing ROI you’ve ever seen before. Our team has the knowledge and experience to promote your NFTs in order to deliver maximum awareness and interest, driving the sales prices up sky-high and beyond.

We provide a full suite of expert NFT marketing services and go above and beyond for every one of our clients to ensure only the best results. Our team will help with everything from minting, listing and selling, NFT creator sourcing, community management and campaign conceptualisation.

So get in touch with us now on 1300 818 435 or message us online.