What is an ERC20 token?

06/05/2022

An ERC20 token is not an all too familiar terminology as it has recently come into existence due to blockchain technology. We’ll explain what an ERC20 token is and why they’re so prevalent in this blog post!

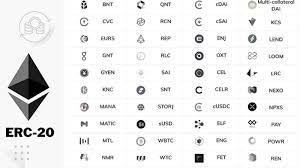

ERC-20 is a form of Ethereum token that adheres to a specified set of rules. Smart contracts on the Ethereum blockchain create these tokens, which the creators can then use to represent anything they like. ERC20 tokens are popular because they are easy to create and use, and they have built-in features that make them more user-friendly than other Ethereum tokens.

Like ABC, XYZ, and so on, each set of ERC-20 tokens has its ticker symbol. For example, there could be 1,000,000 ABC tokens and 10,000,000 XYZ tokens. The number of ERC-20 token sets is in the thousands because of the low barrier to entry. Consequently, the vast majority of them are completely worthless. In contrast, some number in the billions.

Regarding the regulations for how tokens are exchanged, how transactions are approved, and total supply, ERC-20 serves as the technological standard.

ERC-20 tokens are traded by using the digital currency ETH. Therefore, in order to transfer 100 ABC tokens, for example, you will need to include a small quantity of ETH as payment.

ERC-20 tokens come in a plethora of forms. Like a share in a firm, some represent financial assets that are, in some ways, similar. Because these tokens may be viewed as a form of investment, they may be subject to a wide range of legal duties, depending on the jurisdiction.

Loyalty benefits and reputation points can both be represented with ERC-20 tokens. For example, consider an online travel firm that rewards customers with points for each booking they make. To pay for future reservations, these points are exchanged.

Other possible applications include:

- VIP service.

- An equity stake in the booking platform’s revenue.

- Even a say in running the platform.

Because they are traded, the points (tokens) gain value outside of the original ecosystem in which they were produced.

It is also possible to utilize ERC-20 to represent tangible commodities like gold or real estate. However, it becomes more difficult to preserve the link between digital tokens and actual objects when they are used to represent the latter.

Properties of ERC20 tokens

There are many ERC-20 tokens on the Ethereum network, and they’re the most popular.

The following are the respective tokens:

- Fungible: Although transaction histories are utilized to identify and segregate tokens, each token’s coding is the same.

- Can be transferred: You can do so if you want to send them to someone else.

- Fixed Supply: A set quantity of tokens is produced to prevent developers from issuing additional tokens and increasing the supply.

Additional events are triggered by these functions, including the transfer event (which occurs anytime tokens are transferred) and the approval/validation event, which is activated when approval is needed.

Tokens based on the ERC20 standard are traded directly between users or on third-party cryptocurrency exchanges like Coinbase.

6 Different Coding Functions of ERC-20

To help other tokens in the Ethereum ecosystem, ERC-20 provides six possible implementation code functions.

The following are the six most fundamental code functions for ERC-20 tokens:

- total supply: the total quantity of tokens may be determined

- balance of: displays the account balance for a certain address

- Allowance: There are no worries about transmitting tokens from the sender’s address because of the allowance function.

- Transfer: Tokens are transferred from the primary address to the address of a specific user, such as an ICO participant, using the transfer function.

- Approve: It is possible to withdraw cash from a smart contract account up to a defined maximum amount by using an approved function that checks whether tokens have been left in the contract.

- Transfer from: Tokens can be transferred from one user to another using the transferFrom method.

This set of functions and signals assures that Ethereum coins of various kinds will all act uniformly within the Ethereum system. ERC-20-compliant tokens are therefore supported by practically all digital wallets that support Ether.

What are ERC-20 tokens used for? (More Functions)

Various blockchain development companies build these tokens to suit specific functions. The simplest explanation is possible. The features of a token can vary depending on the intended use case, but the basic principles stay the same.

- Tokens based on the ERC-20 standard are frequently used to store value for future use. Tokens represent a certain amount of a particular cryptocurrency in this way. These tokens can be purchased, sold, stored, transferred, and traded on both centralized and decentralized platforms. There is less consistency in these interactions because of the volatility.

- In addition, ERC-20 tokens offer decentralized governance. ERC-20 tokens are often staked in networks that use Proof-of-Stake (PoS) or similar consensus processes. Individuals have a voice in the platform’s development, but evil or fraudulent activity is restricted.

- In decentralized exchange (DEX) protocols, ERC-20 tokens are pooled together to represent liquid marketplaces for assets, such as stocks. Projects can use these pools to kickstart liquidity for their ERC-20 tokens and make trades easier (IDOs). As an alternative, ERC-20 tokens have been used to fund projects via ICOs, STOs, and other similar offerings.

Which cryptocurrencies use the ERC-20 standard?

The ERC-20 framework is used by a surprising number of high-profile crypto projects, including:

- Tether (USDT)

- Chainlink (LINK)

- Binance coin (BNB)

- USD coin (USDC)

- Wrapped Bitcoin (WBTC)

Drawbacks of ERC-20 tokens

- The network becomes less responsive, and transactions become more costly. Transactions can take up to a minute to process because of the network’s slow block time of 14 seconds. This could be perfect for you, or it could be too slow for your needs.

- A fee is paid with Ether, a second cryptocurrency, when a transaction is made. Both time and money are wasted if dust builds up on multiple platforms.

- Ethereum’s scalability issues have resulted in transactions that have been significantly slowed.

- As well as scaling problems, ERC-20 tokens face security difficulties due to the Solidity programming language used by the blockchain.

Chat with the expert NFT promoters and marketers at Mooning

Sure, all the examples of NFT promotions we listed are from global brands with endless coin to throw at their campaigns. But you really don’t need a crazy-high budget to see some seriously incredible outcomes – as long as you know the delicate intricacies of building a killer NFT marketing strategy!

If not, no worries – Mooning is here to take care of everything for you and make sure you see the most amazing ROI you’ve ever seen before. Our team has the knowledge and experience to promote your NFTs in order to deliver maximum awareness and interest, driving the sales prices up sky-high and beyond.

We provide a full suite of expert NFT marketing services and go above and beyond for every one of our clients to ensure only the best results. Our team will help with everything from minting, listing and selling, NFT creator sourcing, community management and campaign conceptualisation.

So get in touch with us now on 1300 818 435 or message us online.